I am currently quite intrigued by the Montessori schooling. Both Google & Amazon founders are Montessori kids and can’t rave about it enough. Acquaint yourself in ‘Montessori and 10 famous graduates from her schools‘.

“D-Mart managed to grow when the industry was collapsing, unscathed by the first wave of e-commerce. Now, as online players eye India’s brick and mortar space and partner with domestic players, what’s D-Mart up to?” Read more here #paywall

The Ultimate Learning Guide via Shane Parrish: A nice curation of some of the best learnings from Farnam Street blog. Find them here

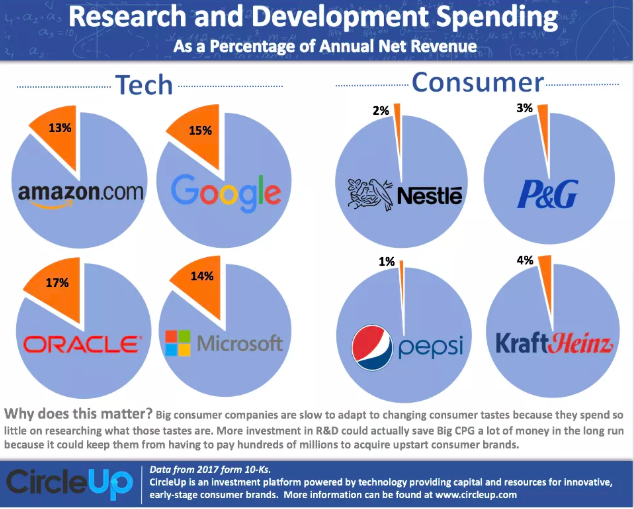

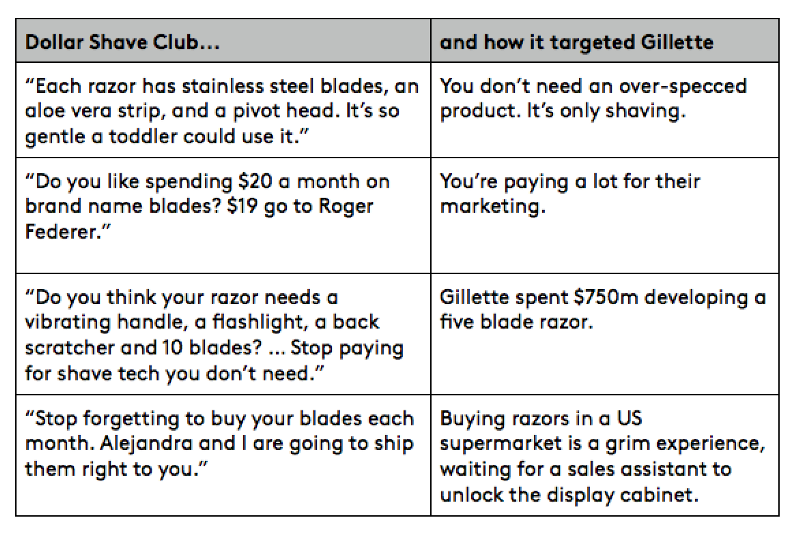

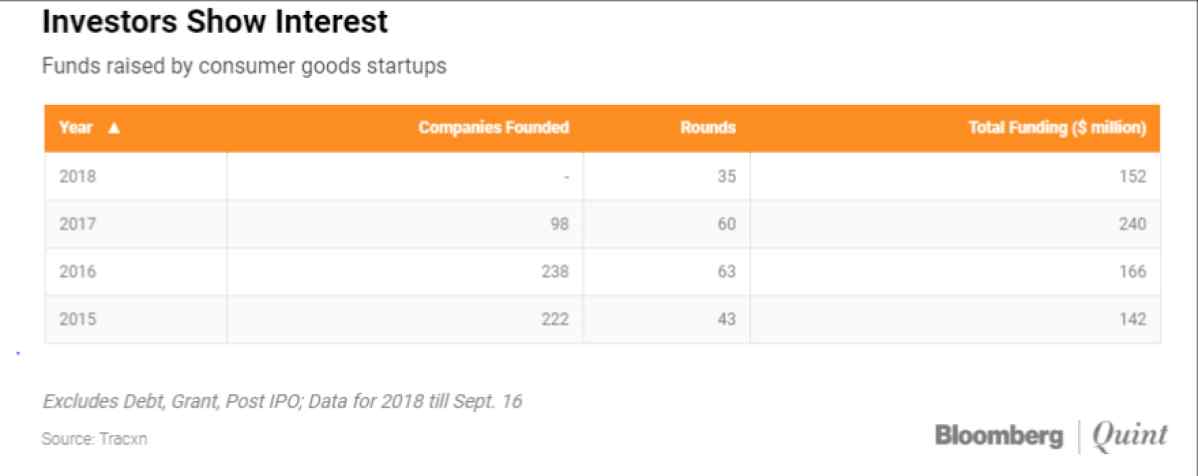

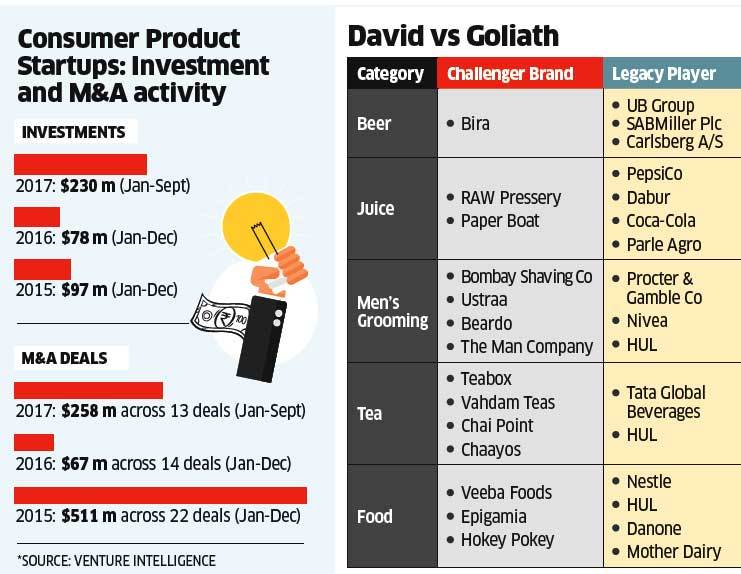

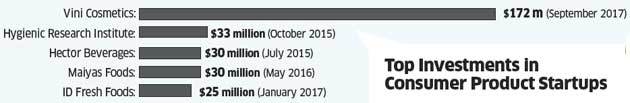

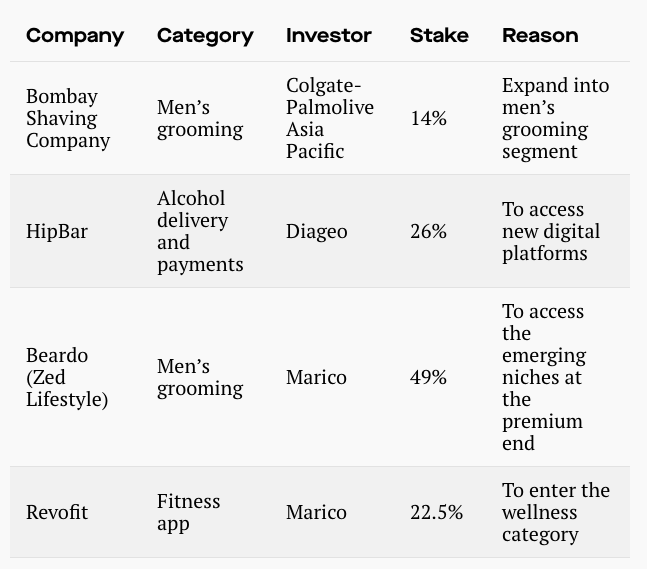

Indian FMCG space is seeing a lot of startup action. It’s not just that the consumer preferences are changing, traditional FMCG companies have also started picking stakes in snazzy upstarts. I’ve shared some thoughts here

The Broken Window Theory In Product Design. Read here

Rewind (Best of newsletter #71)

‘A mile wide, an inch deep’ by Evan Williams. Read here

‘The days are long but the decades are short’ by Sam Altman. Read here

Lessons learned from scaling a product team from Intercom. Read here

Podcast Episode of the Week: When India’s Cash Disappeared, Part One & Two (Planet Money)

A deep dive into how India’s Demonetisation came to be. The background story of Anil Bokil, who originally came up with the idea and convinced PM Modi to make this happen. Also, has the original Arthkranti PPT.

Listen here & here

Startup Trivia of the Week: PolicyBazaar

In 2008, Yashish Dahiya pitched to Sanjeev Bikhchandani with a powerpoint and a prototype of PolicyBazaar. During the demo, he proved to Sanjeev that he was paying around 60% more for his Car Insurance than what he should be. That demo convinced Sanjeev and team, upon which they invested 20Cr in their Series A for a whopping 49% stake. Ten Years later, Info Edge is still participating in all their funding rounds and PolicyBazaar is currently valued at around $1Bn and Info Edge owns around 13% stake.

Feel free to forward this newsletter to anyone who might appreciate it. If you’re getting this email from a friend, you can subscribe here.