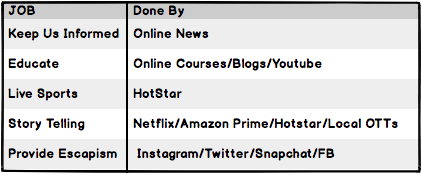

In a 2013 piece, Ben Thompson outlined the following ‘Jobs TV Does’

- Keep us informed

- Educate

- Give a live view of sporting events

- Enlighten and story-tell

- Provide escapism

Subsequently he makes a call for “Unbundling of TV” whereby a different category/product will come about offering a better way to get each of the above mentioned jobs done.

Thing started changing well before Ben wrote that piece and some of those changes seem solidified, at least for now.

Migration from TV to OTT

As per a recent survey by BARC India, 197 Mn homes in India have TV with a total TV penetration of 66%. The survey also shares that over 835 Mn individuals have access to TV. The advertising spend for the medium estimated to be Rs 31,596 Cr ($4.5 Billion).

While TV is enjoying it’s last phase of penetration growth (like print media) there is a big migration from TV underway in India with Gen-Z & Millennials leading the wave.

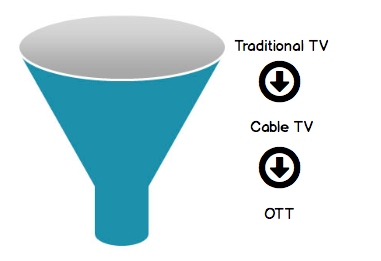

The first phase saw a move from ‘Traditional TV’ to ‘Cable TV’ with a huge portion of country installing set top boxes to get access to niche programming, round the clock at a reasonable price. The second phase is seeing the move from ‘Cable TV’ to ‘OTT/On-Demand Video’.

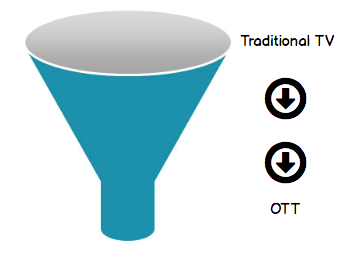

I believe currently this transition is at play with users gradually moving from one stage of the funnel to the next. However, over the next few years most users will skip the set-top box stage and jump straight from TV to OTT platforms.

OTT is High Growth Market

India has been a huge market for Films, TV Shows and Sports. Increasing high-speed internet penetration, falling data prices, entry of big players with huge budgets along with original content aimed (mostly) at youth has over the years set the ball rolling for OTT (Over-The-Top) consumption in India.

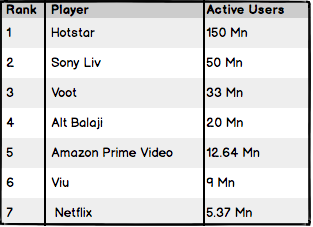

The current Indian streaming market is roughly pegged at $300 million with 30 OTT players with Hotstar being the most popular service.

(source: impactonnet.com)

As of today, OTT is one of the hottest markets in India with everyone scrambling to get a piece of the pie. OTT viewers are growing by 35% Y-O-Y and projected to grow to 355 Mn by 2020. OTT video revenue is expected to reach Rs 5,595 Cr (~$800Mn) by 2022. With projections like these the current gold rush starts to make sense.

OTT Market Players:

With over three dozen players, OTT is becoming a crowded market with players trying to attack it from all sides. From small digital content studios to giant media/production houses, everyone’s got their eyes on the prize.

- Media Groups ( Star, Sony, Zee etc)

- Production Houses (Eros, Balaji Telefilms etc)

- OTT Platforms, International & Local (Netflix, Viu etc)

- Internet Companies (Amazon etc)

- Digital Content Platforms/Studios (Arre etc)

- Others (Aditya Birla Group etc)

A fast growth market with a lot of headroom to grow, voila. However, similar to what I mentioned in ‘The Transportation Layer Protocol of Business‘, while everyone is free to compete, not everyone stands a fair chance at winning. Moreover, even if one is able to create value, in absence of a sound business model, they just might be not to capture it.

Will come back to explore this topic in a later post