If you are part of/related to the Indian e-commerce scene in any manner or read desi start-up blogs, chances are you might be familiar with the concept of Marketplace.

A “Marketplace” connects buyers and sellers who otherwise have trouble finding each other.

Marketplace(think eBay), is simply a model which has multiple sellers providing various goods/services through a platform. In the context of this discussion, an e-commerce website instead of sourcing and fulfilling the orders just manages the listing of products and passes on the order details to the sellers who then handles them.

Recently, India’s biggest online retailer (Flipkart) made their first move as a part of shift towards the marketplace set up.

To start with, Flipkart has on-board 50 sellers that will sell books, media, and consumer electronics.

Other Indian online retailers on scaled up marketplace model are Snapdeal(which recently raised $ 50 mn from ebay and others), Tradus, Infibeam and Shopclues. Let’s understand how the marketplace model and inventory led model compare in execution

The key components of an e-commerce set up are

- Customer Acquisition

- Catalog

- Technology (Customer facing/related and backend)

- Inventory

- Fulfillment (Sourcing, Packaging and Delivery)

- Payment Processing

- Customer Service/Support

Setting everything up for a rookie is quite demanding (capital and effort wise) and will take months to get off the ground, however to signup as a seller on a marketplace and/or opening a shop using SaaS based ecommerce store building platforms like Zepo, Buildabazaar or Martjack is a quickie. So for a newbie it makes perfect sense to open up their own shop (SaaS) and list on various marketplaces as a seller

Based on one’s expertise and priorities there are various ways of building the e-commerce store set up. For eg: while someone will prefer to control the last mile delivery experience, someone would rather let logistics companies take care of that.

The most common model is mix of Inventory led and Marketplace both (think Amazon). Here’s how it works

- Inventory Led – Short Tail (Fast moving, Commodity products, Easy to warehouse for ex: best selling books/movies/pendrives etc)

- Marketplace – Long Tail (Slow moving, Niche products, Difficult to warehouse for ex: medical books published in hindi/very old foreign language films/Furniture etc)

While it might not very clear from the examples but Inventory led model makes sense for products which aren’t perishable(both utility and demand/vogue), are easily available offline too and move fast enough while the Marketplace model makes sense for products which one doesn’t know exist or even if one knows they don’t have any clue on how to stock them, how to source them etc.

Customer Acquisition,Technology,Payment Processing and Customer Support are done by the e-commerce company.

Here’s how various models are implemented in some of the biggest Indian e-commerce companies.

A couple questions come to the the curious mind.

- Why sudden rush towards Marketplace all across?

- Is Marketplace the future of e-commerce in India?

1. Why sudden rush towards Marketplace all across?

The answer to that question (from what I’ve heard) lies in the deep VC pockets. With the Govt of India dillydallying around the FDI regulations for e-commerce, apparently Marketplace is the only way to get external funding needed to sustain the business.

Also, it could be because the bigger e-commerce companies have figured out that

a) they can’t possibly go that strong on increasing the quality/quantity of the catalog on their own

b) they ran sick and tired of doing everything on their own.

To get a sense, compare how Flipkart was managing these functions in it’s previous avatar and compare it to say Snapdeal

2. Is that the future of e-commerce in India?

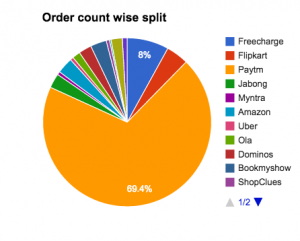

On doing some rough calculations based on the information available Flipkart, Infibeam, Snapdeal, Jabong, Bookadda and Homeshop together would be doing around 1,15,000 orders a day (Flipkart and Snapdeal contributing about 60-70 %).

There are a lot more sites (ending with kart and otherwise) who just might be doing another (20-30,000 transactions or more a day)

As per my guesstimate all independent smaller e-commerce websites and platform powered online shops selling long tail products would be doing not more than 5-10,000 orders a day.These numbers could be significantly different from the mark for all we know but based on these numbers before marketplace became the buzzword, top 5-6 established players were doing about 90,000-95,000 orders a day in total while the others in long tail were about 5-10% of their size.

The balance has started to shift towards the marketplace model transactions. For now their share could be 10-15% of the overall e-commerce transactions. Going forward we’ll a lot more smaller businesses and niche startups coming online and by 2013 end their share could be upwards of 20-25%(going by the fact that between Flipkart and Snapdeal they are the biggest online retailers).

A couple of factors to speed this up would be

- More platforms like Buildabazaar and Zepo

- Better payment gateway/cash collection mechanisms (Ghar pay etc)

- Better logistics (for end to end fulfillment)

- Third party SaaS services for other components like (Catalog, Warehousing, Customer Support)

- Some VC investment in 1-2 marketplace companies

The sooner we get to see the above mentioned things rolling the faster we’ll get to the long tail moving online. At some time in the mid term future(5-7 years) the demand for long tail items (Niche/scarcely available/custom made) products could become comparable if not more than the demand for short tail products.

So the marketplace model and independent shops powered by various sites are here to stay and the current biggies like Flipkart, or maybe Snapdeal will evolve into a mix of (Short tail – Inventory led – Self Fulfilled and Long tail – marketplace – Logistics company) models.

Your thoughts?

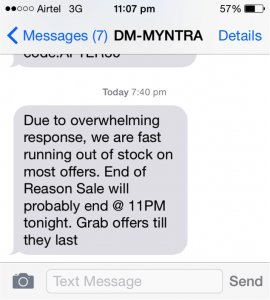

As per Myntra’s twitter account, they were updating the offers

As per Myntra’s twitter account, they were updating the offers