This is second part in a series of posts on ecommerce customer lifecycle management. In the first part we discussed an overview of CLM and in this post we’ll discuss how to identify, measure relevant customer lifecycle metrics and define goals to improve them.

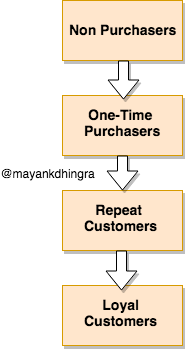

Basic E-commerce Customer Lifecycle.

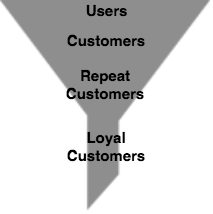

To improve progression of users through the lifecycle we will look at the corresponding funnel as funnels are great to measure stage wise conversion

Quick Definitions

- Total Users: Users with email id/phone number/apn or gcm id.

- Total Customers: Users that have ordered at least once.

- Total Repeat Customers: Customers that have ordered more than once.

- Total Loyal Customers: Customers that have ordered more than Z times.

We’ve mapped the lifecycle into these four basic funnel stages because they represent a user action based milestone. This grouping of users is important because users in each stage share a lot of similarities in their experiences(or lack of) with the product and the kind of nudges required to help them move to the next stage.

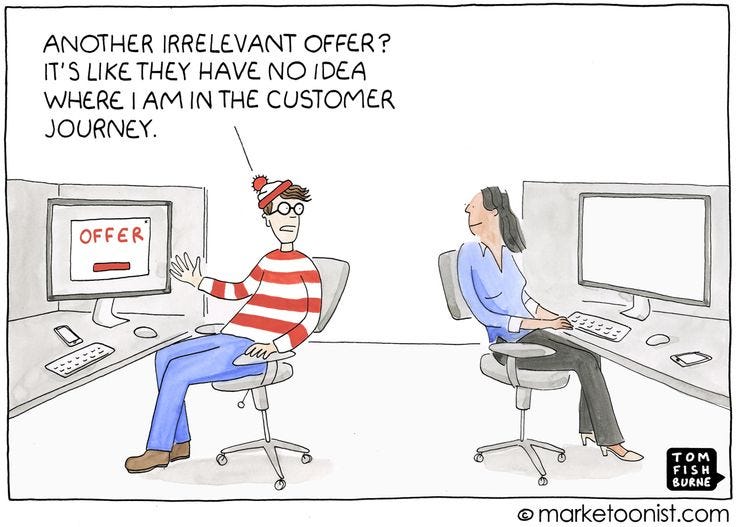

A mistake most marketers tend to make is to send the same communication to all users. It’s wrong to assume that the same communication will work for both ‘Non Purchasers’ and ‘Repeat Customers’.

Identifying Key Customer Lifecycle Metrics

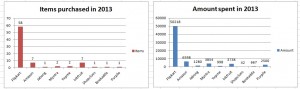

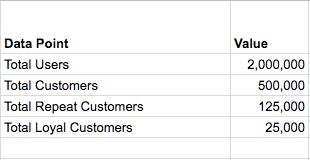

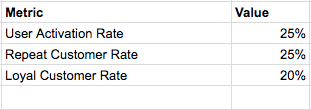

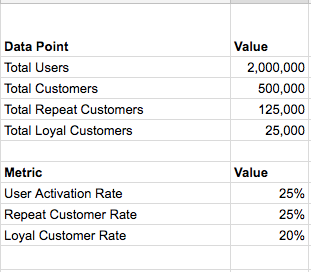

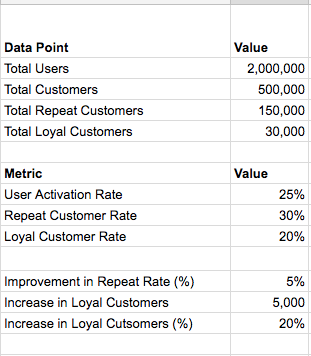

The key metrics to be used have to be leading (or input) metrics i.e they are influenceable or directly actionable. In this case, the relevant metrics are the conversion rates from one stage to another. Let’s take some sample data

At a high level, this table above tells you all there is know about the business and the levers to improve things are the conversion rates that correspond to each stage.

Key CLM Metrics aka E-commerce Vitals:

- User Activation Rate

= (Total Customers /Total Users) * 100 - Repeat Customer Rate

= (Total Repeat Customers/Total Customers) * 100 - Loyal Customer Rate

= (Total Loyal Customers/Total Repeat Customers) * 100

Loyal Customers = Users * Activation Rate * Repeat Rate * Loyal Rate

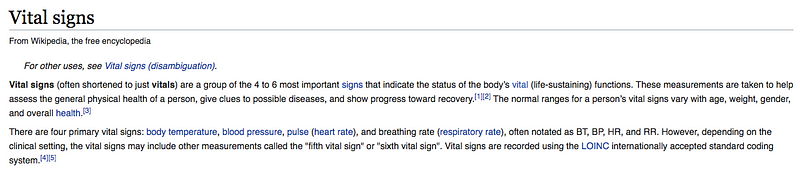

These Key CLM Metrics are E-commerce equivalent to the human body vitals.

As a growth guy, I lay extreme emphasis on these CLM metrics because they help me understand the current state of things and point towards directions that need the most work.

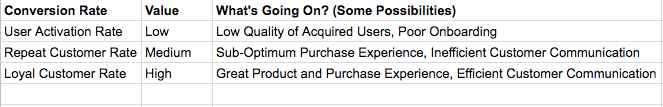

Defining Customer Lifecycle Management (CLM) Goals

With these three metrics identified, the task ahead is clear

Customer acquisition is just half the battle won.

There can be 3 broad goals for improvement from here

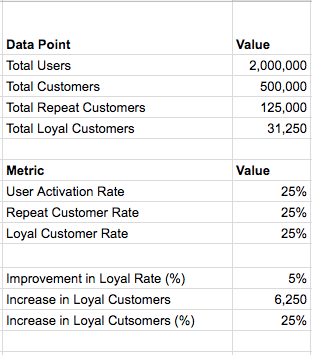

- Increase User Activation Rate (Biggest Improvement Area) — An improvement by 5% here will translate into 20% increase across Customers, Repeat Customers and Loyal Customers

Since User Activation Rate impacts the top of the customer funnel and a small improvement here will have the maximum impact in both customer count and revenue, it is paramount to improve it ASAP.

2. Increase Repeat Customer Rate (Toughest Improvement Area) — This is the second biggest improvement area. An improvement by 5% here will translate into 20% increase in both Repeat & Loyal Customers

If there are a lot of folks who are placing orders but aren’t coming back to buy again this could be a serious problem. This metric needs to be looked from multiple perspectives — Product Quality, Post Purchase Experience, Post Purchase Communication and such.

3. Increase Loyal Customer Rate (Easiest Improvement Area) — An improvement by 5% here will translate into 25% increase in Loyal Customers.

In my experience I’ve found this metric easier to influence than the repeat rate. Customers that have made multiple purchases are comparatively easier to retain & re-activate. You also have the most behavioural data about them.

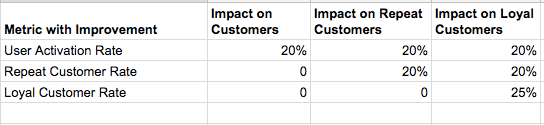

Here’s a quick summary showing the impact of a 5% improvement in each key metric on One Time Purchasers, Repeat Customers and Loyal Customers.

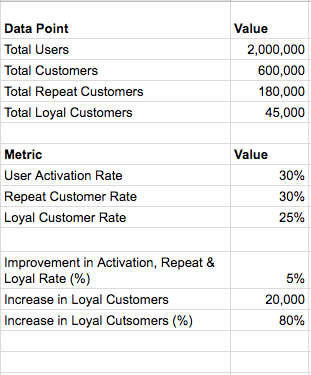

The table above summarises the impact pretty neatly. In case, this is looking exciting, let me add to the excitement by showing you the improved numbers in a case where you are able to increase each key CLM metric by just 5%.

Not only the % of people in each lifecycle stage looks quite better, the increase in loyal customers by 80% is fantastic

With these three broad CLM goals defined and projections explored, we have a task cut out for the marketing/growth team to make plans around.

In this post we’ve focused on identifying the Key CLM Metrics and Defining CLM Goals. In the next post in this series we’ll discuss some strategies to achieve these goals.

If this is the first post you are reading in this series, there’s a prequel to this post on introduction to Ecommerce Customer Lifecycle Management here

Thanks Navneet Singh and Saurabh Tuteja for their feedback